18 Year Project Finally Completed / Big Tax Changes -Propose

ISSUE #829: Sept. 13-19, 2020

2020-09-20

Brian Timmons

Dear friends,

When I started Residencias Los Jardines, I started writing a weekly newsletter -determined to tell all the good, bad, and the ugly. I knew some readers would be interested in the construction process. I expected others might be interested in the lifestyle of two people who had decided to live outside the box. For others, the adventures of Lita, the parrot and the cat took on an entertainment saga all its own.

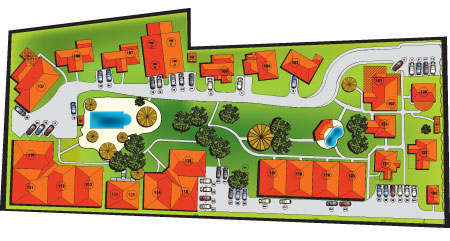

Residencias Los Jardines is finished. We periodically have re-sales and rental availability. Some readers may be interested in this information.

Brian Timmons

Developer / Property manager

Residencias Los Jardines

Web: https://www.residenciaslosjardines.com

Emails: info@residenciaslosjardines.com

ResidenciasPropertyManagement@gmail.com

rentals & sales

Paradisus Condos / Rohrmoser

FOR SALE / RENT

Visit our website

Each of the units consists of two bedrooms / two bathrooms, and a large living/dining/kitchen area. The floor plan of each of these units has eliminated the optional "den / office" divider. The result is a larger area offering more flexible furniture arrangements while still maintaining the option of including an office area. At 105m2 plus two parking spots each and storage locker, they offer a great opportunity for someone seeking views, security, central location, and first class, all round living...

PRICE REDUCTION

Semi furnished unit: For sale: $235,000

Fully furnished unit: For sale: $245,000

Floor 12 -west view

sales & rentals

Sales: Los Jardines: Units #116 and #124

Rentals: Los Jardines: Available immediately: #106C $900 mo. / #121 $1,300 mo. / #126 $650 mo.

property management, rentals & re-sales

FOR SALE

Unit #116: $ 195,000 $ 189,995 / See Unit

Unit #124: $ 125,000 $ 115,000 / See Unit

FOR RENT

Unit #106C: $900 mo. / Available immediately / See Unit

Unit #121: $1,300 mo. / Available immediately / See Unit

Unit #126: $650 mo. $625 mo. / Available immediately / See Unit

UNIT #116

FOR SALE

$ 195,000 $ 189,995

Total Area (Sq Ft): 1290

Total area (Sq M): 120

Bedrooms: 2

Bathrooms: 2

Floor(s): 1

Type: Semi-Attached

Furnished: Yes

This 1,290 sf single floor home includes a 300 sf front terrace plus parking for one car and a separate, secure storage locker. It is and end unit and therefore attached on only one side by a 6 inch cement demising (common) wall, which prevents sound transfer.

UNIT #124

FOR SALE

$125,000 $ 115,000

Total Area (Sq Ft): 662

Total area (Sq M): 61

Bedrooms: 1

Bathrooms: 1

Floor(s): 2nd Floor

Type: Semi-Detached

Furnished: Yes

This 662 sf, + covered parking for one car, is a one bedroom home on the 2nd floor overlooking the large pool. It is ideal for a single person or couple.

UNIT #106C

FOR RENT

$900 mo.

Available immediately

Total Area (Sq Ft): 1250

Total area (Sq M): 120

Bedrooms: 2

Bathrooms: 2

Floor(s): 1 Floor

Type: 4-plex

Furnished: Yes

This is a fully furnished 2-bedroom unit situated in a 2-story building, which has two units on the ground floor and two units on the 2nd. floor. Each unit is the same size (1,250sf) divided into 800 sf of interior space and 450 sf of covered front and back terraces. Units 106A and B are on the ground floor; Units 106 C and D are on the 2nd. Floor. The solid masonry demising wall (common wall) as well as the 5” concrete slab prevent sound transference.

UNIT #121

FOR RENT

$1,300 mo.

Available immediately

Total Area (Sq Ft): 1432

Total area (Sq M): 131

Bedrooms: 2

Bathrooms: 2.5

Floor(s): 2 Story

Type: Detached

Furnished: Yes

This is a detached, two story, two bedroom, 2 1/2 bathroom house. It is nicely furnished as the prictues indicate. Ground floor consists of den/TV room, dining room, living room, kitchen, and 1/2 bathroom. Second floor: master bedroom with full bathroom including a jacuzzi, 2nd bedroom with ensuite bathroom, terrace.

UNIT #126

FOR RENT

$650 mo. $625 mo.

Available immediately

Total Area (Sq Ft): 530

Total area (Sq M): 50

Bedrooms: 1

Bathrooms: 1

Floor(s): 1st Floor

Type: Detached

Furnished: Yes

A small one bedroom with outside covered terrace with top of the line finishes (granite, stainless steel appliances, fine crafted wood cabinetry, +, +, +), with lots of well thought out storage...

What Happened This Week

Weather: Normal rains for this time of year.

Stories

1. Opening Up: Life becomes the new normal... minus a number of businesses... and 25% unemployment

2. 18 Year Project Finally Completed: I planned ahead but did not follow through until this week. When buiilding, I realized we needed water to the sidewalk planter area. I put in a 1" line under the sidewalk and garbage area with a shut off valve on the inside. I remembered it was there but had forgotten EXACTLI where... well the guys found it, pretty close to where I expected, cracked the shut off valve and water gushed out in the right area... Woopie!!!!!! not only did I plan ahead, I remember it as well... (that is even more significant). We finished removing the stressed plants, instalaled an irrigation system, laid sod. Not very exciting but it is practicle. I reviewed the installation today. And as I suspected, the irrigation heads are not correctand cannot be adjusted properly. The guys did not understand and thought a 180 degree arc would work -the local supplier of the irrigation pieces didn't know either... it evidently takes an old fart (I qualify) to know the difference between the right product and the wrong product... Monday I will drive to La Garita (20 min) hoping to find the distributer of irrigation pieces... I hope... I hope, I hope...

3. Foreclosure/Repossession: We wait...

4. Market Activity: Several viewings... not great clients... and fortunately no takers...

5. Security Cameras: As stated last week, this is back on my agenda. I have a person coming Thursday. Hopefully he will get it resolved.

Comments:

1. It is Time to Pay the Piper: CR is reaching it's end point of being able to borrow -it has to go the the IMF- which conditions loans on fiscal reforms. Government wants $1,75 billion of bail out money is is proposing a number of new taxes... yes, they way they will also cut costs but we know that that never actually happens... The taxes proposed may undergo substantial changes but they involved charges on all financial transactions (supposedly designed to raise the equivilent of 3 pts of the GDP, doublt or trible the property taxes, and increase income taxes... It is hard to figure out right now the actual consequences of this but certainly the cost of living will increase subsantially, more payments will be driven underground, and regardless of the features to attract expats, this will be a significant deterrent. Will the government REALLY cut thier expenses? Ha!! teachers are now working on a third year of full pay and no effective teaching... the court system has ground to a halt, Immigration is closed still, so many government people receiving substantial pay for no productivity... amongst my friends, we have often felt that property taxes needed to increase. The tax on financial transaction will affect mainly the wealth and businesses... poor use cash or barter... the increased income tax seems significant but I suspect so few people here actually pay income tax that it won't contribute much regardless of the efforts the government has taken to curb cash transactions...

1. Costa Rica proposes tax measures as part of IMF negotiations

The Costa Rican Presidency on Thursday announced the fiscal measures it will present to the International Monetary Fund (IMF) as part of negotiations to secure $1.75 billion in financing.

According to a statement from Casa Presidencial, the changes are intended to protect key institutions — such as the Social Security System (CCSS) — and avoid placing undue burden on the middle and lower classes.

“We have set out to build a proposal to achieve a reasonable agreement, which includes a significant decrease in spending and an increase in income,” said Elián Villegas, Minister of Finance.

The three-year agreement with the IMF “is our best option,” said Rodrigo Cubero, president of the Central Bank.

Government proposes tax measures

The government introduced tax measures on income, expenditure and assets.

Among them is a 0.3% fee on banking transactions for two years, subsequently dropping to 0.2% for a further two years.

“It is projected that with this tax, it is possible to finance what will no longer be received by social charges and the reduction of public debt,” Casa Presidencial said.

Income taxes would also increase for Costa Rica’s highest earners. An additional 2.5% would be charged for those making above ¢840,000 monthly (about $1,400); an additional 5% for those making above ¢1,233,000 (about $2,050); and an additional 10% for income greater than ¢4,325,000 (about $7,250).

Businesses and legal entities with large net incomes would also see a tax increase depending on their reported income.

A 5% tax would be charged “for remittances abroad to income from Costa Rican sources of natural and legal persons not domiciled in Costa Rica.”

Finally, the government proposed an increase of 0.5 percentage points in property tax on real estate, and the elimination of tax exemptions to cooperatives, among others.

The government hopes to reduce its costs through the closure or merger of decentralized bodies, the elimination of annuities, the reduction of political debt by 50%, the process of voluntary mobility of public officials, and the sale of assets such as the National Liquor Factory (FANAL) and the International Bank of Costa Rica (BICSA).

All measures will be brought to the Legislative Assembly for debate; they will also be presented to the IMF.

Costa Rica’s negotiations with the IMF

Costa Rica requested $1.75 billion in financial assistance from the IMF as part of the entity’s Extended Fund Facility (EFF).

It represents Costa Rica’s first EFF negotiations since the financial crisis of the early 1980s. At the time, Costa Rica struggled to adhere to the IMF’s terms.

“When a country borrows from the IMF, it commits to undertake policies to overcome economic and structural problems,” the organization says. “Under an EFF, these commitments, including specific conditions, are expected to have a strong focus on structural reforms to address institutional or economic weaknesses, in addition to policies to maintain macroeconomic stability.”

The IMF was founded in 1945 and is headquartered in the United States. Costa Rica is an original member of the organization, though its membership didn’t become official until early 1946.

Costa Rica has a history of lending commitments with the IMF. The majority were stand-by arrangements (SBA), which are short-term loans with fewer conditions.

Most recently, the IMF in April approved $504 million in emergency assistance to help Costa Rica address the coronavirus pandemic.

Prior to the pandemic, the IMF said Costa Rica’s economy had “turned around since mid-2019” with modest growth expected in 2020.

Costa Rica’s negotiations with the IMF regarding the EFF are expected to begin later this month.

2. Taxes on Bank Transactions? This is part of the Costa Rican Government’s Proposal to the IMF

The Government of Costa Rica presented this Thursday to the Legislative Assembly the proposal (Plan to overcome the fiscal impact of the pandemic) to negotiate with the International Monetary Fund for a new loan of $1.750 Billion.

“We need to maintain economic stability and activate employment to improve the situation in the country generated by COVID-19. If we do not act, the risk is in the high interest rates, devaluation, more unemployment, and poverty, which would affect everybody and in particular those with less resources. For this reason, we need to act and do it fast, the delay on this would be awfully expensive”, stated President Carlos Alvarado.

The President made emphasis in that those that “have more” will pay more.

Under this scenario, some of the proposals include:

• A temporary tax to all financial transactions that would be of 0.3% over the amount of the transfer for the years 2021 and 2022 and 0.2% the following two years.

This includes ALL bank transactions. (Deposits, Withdrawals, Transfers etc)

According to Treasury Minister Elian Villegas, this is the equivalent in income for the state of changing the VAT from 13% to 20% and the idea is to finance the elimination of a 5% that is currently paid by employers as part of their social security fees to FODESAF

• A raise in the percentage paid as income tax for salaries over ¢840,000 (approx. $1,425.00 USD), meaning that:

Salaries over ¢840,000 and under ¢1,233,000 (approx. $2,090.00 USD) will go from paying 10% to paying 12.5%.

Salaries over ¢1,233,000 and under ¢2,163,000 (approx. $3,666.00 USD) will go from paying 15% to paying 20%.

Salaries over ¢2,163,000 and under ¢4,325,000 (approx. $7,330.00 USD) will go from paying 20% to paying 25%.

Salaries over ¢4,325,000 will go from paying 25% to paying 35%.• Tax over lottery prizes: A 25% tax would be applied to prizes that exceed 50% of a base salary.

• Property taxes to go from 0.25% to 0.75% with the differential to be transferred to the central government instead of the municipalities.

The government argues that they are looking for “balance” and therefore they will not raise the percentage of VAT, salaries under ¢840,000 will remain intact (without tax deduction), they will not implement mass layoffs and will only resort to the sale of the actives the government had committed to publicly, which include the National Liquor Factory (FANAL) and the International Banco of Costa Rica (BICSA).

Costa Rica already faced a complicated fiscal situation since before the pandemic and because of the effects of the pandemic expects the worse economic contraction since 1980.

The proposal will have to be approved by the Legislative Assembly in order to present it to the IMF by the beginning of October.

Previous reports

2024

2023

2022

2021

2020

2019

2018

2017

2016

2015

2014

2013

2012

2011

2010

2009

2008

2007