Steadying the Ship...

ISSUE #774: Aug. 18-24, 2019

2019-08-26

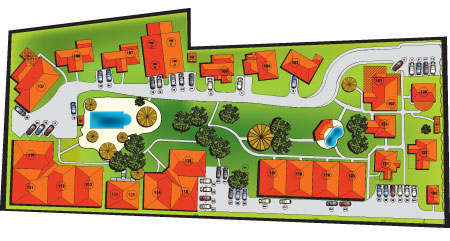

Brian Timmons Dear friends, When I started Residencias Los Jardines, I started writing a weekly newsletter -determined to tell all the good, bad, and the ugly. I knew some readers would be interested in the construction process. I expected others might be interested in the lifestyle of two people who had decided to live outside the box. For others, the adventures of Lita, the parrot and the cat took on an entertainment saga all its own. Residencias Los Jardines is finished. We periodically have re-sales and rental availability. Some readers may be interested in this information. Brian Timmons |

|

Featured

rentals & sales Paradisus Condos / Rohrmoser

Each of the units consists of two bedrooms / two bathrooms, and a large living/dining/kitchen area. The floor plan of each of these units has eliminated the optional "den / office" divider. The result is a larger area offering more flexible furniture arrangements while still maintaining the option of including an office area. At 105m2 plus two parking spots each and storage locker, they offer a great opportunity for someone seeking views, security, central location, and first class, all round living... PRICE REDUCTION |

|

Market activity

sales & rentals Sales: Los Jardines: Units #114, #116 and #124 Rentals: Paradisus: Nothing available Los Jardines: Units #106C, #106D and #113 |

|

Residencias Los Jardines

property management, rentals & re-sales FOR SALE FOR RENT For sale

UNIT #114 Total Area (Sq Ft): 1290 This 2 bedroom/2bathroom,1,290 sf single floor end unit home includes a 150 sf front terrace plus parking for one car. This house is fully air conditioned and has recently been professionally decorated by international decorator Alcides Graffe and has undergone a complete renovation—new modern furniture, finishings, window coverings, and art work by Carlos Gambino. It is arguably the nicest furnished unit at Residencias Los Jardines and only steps from the pool UNIT #116 Total Area (Sq Ft): 1290 This 1,290 sf single floor home includes a 300 sf front terrace plus parking for one car and a separate, secure storage locker. It is and end unit and therefore attached on only one side by a 6 inch cement demising (common) wall, which prevents sound transfer. UNIT #124 Total Area (Sq Ft): 662 This 662 sf, + covered parking for one car, is a one bedroom home on the 2nd floor overlooking the large pool. It is ideal for a single person or couple. For rent

UNIT #106C Total Area (Sq Ft): 1250 This is a fully furnished 2-bedroom unit situated in a 2-story building, which has two units on the ground floor and two units on the 2nd. floor. Each unit is the same size (1,250sf) divided into 800 sf of interior space and 450 sf of covered front and back terraces. Units 106A and B are on the ground floor; Units 106 C and D are on the 2nd. Floor. The solid masonry demising wall (common wall) as well as the 5” concrete slab prevent sound transference. UNIT #106D Total Area (Sq Ft): 1227 + parking This 2nd story, 1,227 sf (113 m2 + one parking space) is a georgous home with one of the best views at Los Jardines. The very large front covered terrace faces east and is suitable for entertaining; the off-bedroom covered terrace faces west for sun sets. This very tastefully furnished and fully equipped home offers a lifestyle envied by many. UNIT #113 Total Area (Sq Ft): 1290 This 1,290 sf single floor home includes a 300 sf front terrace plus parking for one car. It is attached on one side by a 6 inch cement demising (common) wall, which prevents sound transfer. The three other sides allow light, ventilation and garden views. |

|

Our Lives

Rainy Season... We have had a little rain but not enough to replenish the ground water... plants are happy... only minor watering this past week. What Happened This WeekVacancies: Another week and not one inquiry... Another week and not one inquiry... this is becoming chronic. One owners are now having to flow money back into their units... they are not happy nor anxious about doing that... we'll see... Steadying the Ship...: I continue to look after the infrastructure. We had a pressure tank for drinking water fail. We replaced it and something has failed again... We are working on it. Fortunately, we have two tanks so we can limp along seamlessly to residents. We are finally about ready to finish the reconditioning of 108. This has taken a long time as workers have been diverted to various other needy areas and have not been given specific direction and enforcement of those directions to finish it. Now, I am focusing their effort... we are making progress. This week with be a bit of a hiatus re. building reconditioning because they same two workers will have to focus on trimming the garden items... that will take the week. When they return to building mtnc, they will focus on the front wall / street presence. That should be a couple week's work ...and from there, I expect they will return to finish off the exterior of 103. That is far enough ahead for planning. Hopefully, we will get the office team in place this week and begin the process of getting sorted out. Update of Shareholder Agreement: One of the outstanding issues not yet completed, is the updated Shareholder Agreement. Over the years, the shareholders have made changes to the agreement. The old timers can remember those changes but the newbies cannot possibly know. In addition, we now have a sufficient number of Spanish first language owners so we need to translate this into Spanish. The corporate lawyer has had this as a job assignment for a long time. He has not been diligent and has not been whipped enough. I am now the whipping boy... he is getting a regular dose of the whip so I expect to finally receive this. We have a known resource to translate it... "La Trinidad" Foreclosure: ...I continue to look for a buyer... a couple of weak possibilities. One of these days, I will just have to pull the trigger on foreclosure... INS Suit: I haven't heard if they appealed... but I am sure they did. Wine Club: This will happen tomorrow... 29 attendees. Hopefully as great as last year... that will fulfill my obligation for this year... I can relax... |

|

News Items of the Week

COMMENTS 1. Unemployment: 65% of the workforce lives in the Greater San Jose Area... it is hurting... 2. Dollar Appreciation: Only in Costa Rica does the dollar devalue against the local currency... All over the world, the opposite is the case...

|

|

FOR RENTAL OR SALES INFORMATION Brian C. Timmons Costa Rica: Canada: Web: https://www.residenciaslosjardines.com |

Previous reports

2024

2023

2022

2021

2020

2019

2018

2017

2016

2015

2014

2013

2012

2011

2010

2009

2008

2007