Mismatches / Dumb Machines / Financial Ignorance

ISSUE #724: Aug. 19-25, 2018

2018-08-28

Brian Timmons Dear friends, When I started Residencias Los Jardines, I started writing a weekly newsletter -determined to tell all the good, bad, and the ugly. I knew some readers would be interested in the construction process. I expected others might be interested in the lifestyle of two people who had decided to live outside the box. For others, the adventures of Lita, the parrot and the cat took on an entertainment saga all its own. Residencias Los Jardines is finished. We periodically have re-sales and rental availability. Some readers may be interested in this information. Brian Timmons |

|

Featured

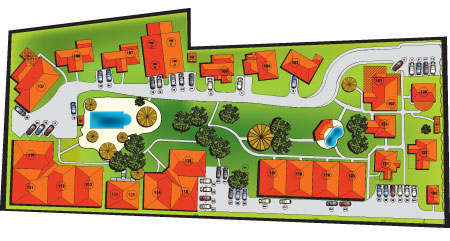

rentals & sales Paradisus Condos / Rohrmoser

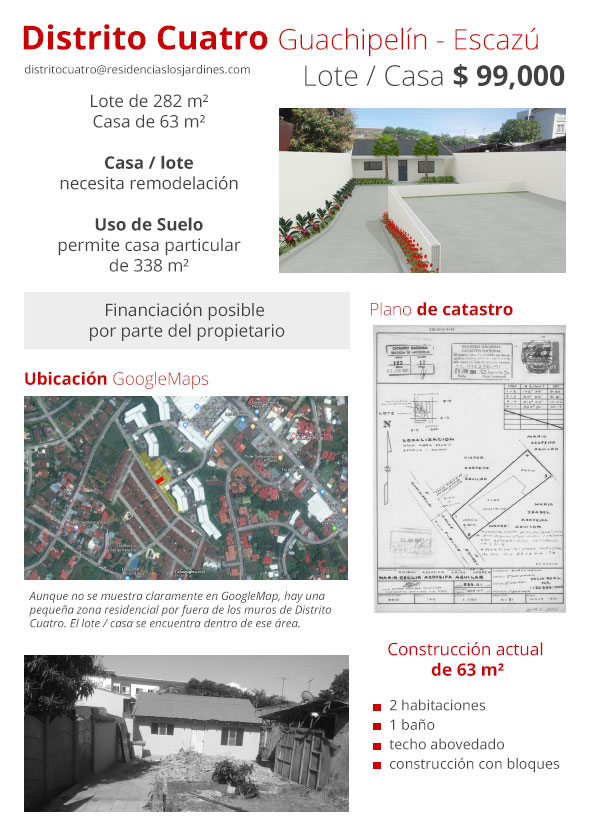

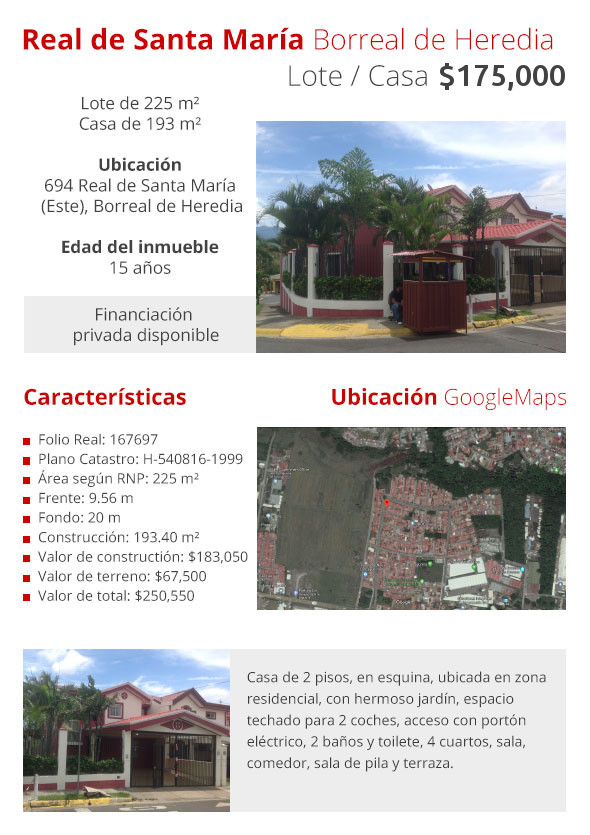

Each of the units consists of two bedrooms / two bathrooms, and a large living/dining/kitchen area. The floor plan of each of these units has eliminated the optional "den / office" divider. The result is a larger area offering more flexible furniture arrangements while still maintaining the option of including an office area. At 105m2 plus two parking spots each and storage locker, they offer a great opportunity for someone seeking views, security, central location, and first class, all round living... PRICE REDUCTION Distrito Cuatro / Guachipelín / Escazú DOWNLOAD PDF    .jpg)    .jpg) .jpg) Real de Santa María / Borreal de Heredia

Download more pictures (8.35 Mb) Hyundai Santa Fe 2008 Hyundai Santa Fe 2008, Turbo Diesel, automatic, excellent family vehicle, safe, comfortable, interior with leather seats. Good tires, engine, turbo, suspension, and AC. Marchamo 2018 and Retive. It now has been road tested for 5 weeks and performed flawlessly. I can now sell with confidence...

|

|

Market activity

sales & rentals Sales: Los Jardines: Units #114 and #124 Rentals: Paradisus: Nothing available Los Jardines: Unit #106C available September 1st |

|

Residencias Los Jardines

property management, rentals & re-sales FOR SALE FOR RENT For sale

UNIT #114 Total Area (Sq Ft): 1290 This 2 bedroom/2bathroom,1,290 sf single floor end unit home includes a 150 sf front terrace plus parking for one car. This house is fully air conditioned and has recently been professionally decorated by international decorator Alcides Graffe and has undergone a complete renovation—new modern furniture, finishings, window coverings, and art work by Carlos Gambino. It is arguably the nicest furnished unit at Residencias Los Jardines and only steps from the pool UNIT #124 Total Area (Sq Ft): 662 This 662 sf, + covered parking for one car, is a one bedroom home on the 2nd floor overlooking the large pool. It is ideal for a single person or couple. For rent

UNIT #106C Total Area (Sq Ft): 1250 This is a fully furnished 2-bedroom unit situated in a 2-story building, which has two units on the ground floor and two units on the 2nd. floor. Each unit is the same size (1,250sf) divided into 800 sf of interior space and 450 sf of covered front and back terraces. Units 106A and B are on the ground floor; Units 106 C and D are on the 2nd. Floor. The solid masonry demising wall (common wall) as well as the 5” concrete slab prevent sound transference. |

|

Our Lives

Weather: Normal rainy season weather... wonderful... What Happened This Week:Is "Maybe" Coming?: (Part 2) The would-be buyer said he had a CD. Just needed to cash it... we are now 2 1/2 weeks later and -guess who --Scotiabank-- needs a bit more time... perhaps another week. Supposedly they need more paperwork from the client? Mismatchs: Type "A" personalities don't survive CR. Anyone not able to accept gliches, chaos, uncertainty, unreliability, who are inflexible (must have a certain brand of oatmeal / peanut butter / yogurt, etc, need not come here. they won't last, will be miserable, and will cause those around them to be miserable as well. We have a recent tenant who, after 6 weeks, has decided (rightly so) that CR is not for him. Know thyself / do your research... for some the green grass on the other side of the fence is a mirage... Santa Fe: One caller who had to see it right away... it was night time... would check with her husband / guess he was unimpressed... I haven't heard back. But I do have some one else looking today... perhaps it will be sold today... if so, one thing down... many to go... Clueless in CR: Distritocuatro: several showings... another in an hour. Had a half-hearted offer... again the client and their agent have no clue. They were going to borrow $60K from the bank, and wanted $39K VTB. They had no idea how to calculate simple interest nor what the total monthly nut would be. And under this scheme, they had no money in the deal and I would have no security... they are used to CC monthly interest payments and do not seem to have a clue beyond that. Meanwhile, I wait for Scotiabank to release CD funds... Heredia House: Looking good / looking lonely -no calls. |

|

News Items of the Week

Comments: 1. New Tax Package: it continues to work its way through the government processes. A number of changes are proposed... some of which will be incorporate / some will be dropped. Eventually, something will come out at the end. It will be a game changer for many.

|

|

FOR RENTAL OR SALES INFORMATION Brian C. Timmons Costa Rica: Canada: Web: https://www.residenciaslosjardines.com |

Previous reports

2024

2023

2022

2021

2020

2019

2018

2017

2016

2015

2014

2013

2012

2011

2010

2009

2008

2007