Taxes, Taxes, Taxes... well maybe AND A Bizzare Blowthrough

ISSUE #572: Aug. 9-15, 2015

2015-08-18

Taxes, Taxes, Taxes...well maybe AND A Bizzare Blowthrough

Brian Timmons

Dear friends,

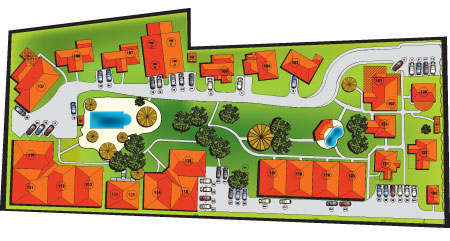

When I started Residencias Los Jardines, I started writing a weekly news letter -determined to tell all the good, bad, and the ugly. I knew some readers would be interested in the construction process. I expected others might be interested in the lifestyle of two people who had decided to live outside the box. For others, the adventures of Lita, the parrot and the cat took on an entertainment saga all its own.

Residencias Los Jardines is finished. We periodically have resales and rental availability. Some readers may be interested in this information.

Brian Timmons

DEVELOPER / PROPERTY MANAGER

Residencias Los Jardines / https://www.residenciaslosjardines.com info@residenciaslosjardines.com

ResidenciasPropertyManagement@gmail.com

Featured house this week

Paradisus Condos / Rohrmoser

FOR SALE / FOR RENT

Each of the units consists of two bedrooms / two bathrooms, and a large living/dining/kitchen area. The floor plan of each of these units has eliminated the optional "den / office" divider. The result is a larger area offering more flexible furniture arrangements while still maintaining the option of including an office area. At 105m2 plus two parking spots each and storage locker, they offer a great opportunity for someone seeking views, security, central location, and first class, all round living...

Residencias Los Jardines

Property Management, Rentals, Re-Sales

Market Activity

Sales: no inquiries.

Rentals: two lookers; no commitment.

FOR SALE

Unit #110: $215,000 / See Unit

Unit #114: $235,000 / See Unit

Unit #116: $214,000 / See Unit

FOR RENT

Unit #124: $850 mo. / Available Immediately / See Unit

HOUSES FOR SALE

UNIT #110

FOR SALE $215,000

Total Area (Sq Ft): 1290

Total area (Sq M): 120

Bedrooms: 2

Bathrooms: 2

Floor(s): Single Floor

Type: Attached

Furnished: Yes

Beautiful end-unit bungalow (one floor) town home (part of 4 homes) situate at the far quiet end of Residencias Los Jardines, steps from the main pool. It includes one designated parking spot and one storage unit. The home is 120 square meters (approximately 1,300 square feet) with two bedrooms (master has king size bed and guest has queen size bed), two full bathrooms (one being an ensuite), a large open concept kitchen, living room, dining room, granite breakfast bar with stools and features vaulted ceilings and lots of windows. The home has a large covered terrace overlooking the gardens. Custom made wood blinds cover all windows throughout. Ceiling fans in bedrooms, living room and terrace.

UNIT #114

FOR SALE $235,000

Total Area (Sq Ft): 1290

Total area (Sq M): 120

Bedrooms: 2

Bathrooms: 2

Floor(s): Single Floor

Type: Attached

Furnished: Yes

This 1,290 sf. (plus covered parking for one car and two lockers 67 sf.) single story, semi detached house, with garden terrace, two bedrooms is a beautiful executive style home. This home consists of two large bedrooms one with six piece en-suite bathroom with additional access to separate full shower. Each bedroom has large closets with extensive built-ins for personal organization. The vaulted living room and bathroom ceilings provide a feeling of grandeur while allowing the warmer air to rise and exit through the ceiling ventilating system. There are four TVs (one in each bedroom, one in the living room and one in breakfast / dinning room.) This is a beautiful well appointed home.

UNIT #116

FOR SALE $214,000

Total Area (Sq Ft): 1290

Total area (Sq M): 120

Bedrooms: 2

Bathrooms: 2

Floor(s): Single Floor

Type: Semi-Attached

Furnished: Yes

This 1,290 sf single floor home includes a 300 sf front terrace plus parking for one car and a separate, secure storage locker. It is and end unit and therefore attached on only one side by a 6 inch cement demising (common) wall, which prevents sound transfer.

HOUSES FOR RENT

UNIT #124

FOR RENT $850 mo. Available Immediately

Total Area (Sq Ft): 662

Total area (Sq M): 61

Bedrooms: 1

Bathrooms: 1

Floor(s): Second Floor

Type: Semi-Detached

Furnished: Yes

This 662 sf, + covered parking for one car, is a one bedroom home on the 2nd floor overlooking the large pool. It is ideal for a single person or couple.

Our Lives

WEATHER: normal rainy season weather

Bizzare:

This week saw a whirlwind of bizzare... a rental client commited to a unit which was to become available in 10 days. In the interim, I put him and his pregnant girlfired up in another unit in which I had a two week vacancy. He, in his early 60s, his 3 mo. pegnant girlfriend from SE Asia moved in. She is experiencing pregancy problems... doctors come and go; he is selling his business with 55 employees and his matrimonial home... he isn't yet divorced, his wife doesn't know about his pregnant girlfriend, one son knows, the other son doesn't, his girlfriend is still married and the husband has made threats against the family and himself... great... he gets a call that his mother in N. Am. has had a stroke; since there is no one else to care for her, he has to return for an indeterminate period, but first sends money... puts the pregnant girlfriend on a 72 hr. return flight... neither are likely to be seen nor heard from again... leaving behind a security deposit which had been paid to the rental agent, and a month's rent... this is a guy who has had a heart attack and has 6 stents in his chest and suffers from high blood preassure -I now re-clean up the unit and re-market the unit... wow... most of us have unresolved issues but I don't remember anyone having this many... I'll keep my own issues, he can have his... Both were nice people...

News Items of the Week

Comments

1, 2, 3. Tax proposals before the Government. Most of these are not new, they were submitted last year and all got buried. While many are worrisom to those of us who live here and feel that many, if implemented, will kill the goose, I am hoping that the most important article related to these is Article 4...

5. CR politial environment... a mess... a "dysfunctional democracy" it is and a leader who has no political capital and a country which is floundering... spending is out of control and debts are coming due and there is no viable plan to repay them and no one currently capable of solidifying the country's future direction... and the creditors may well loose their patience, especially after the Greece fiasco.

6. New CR airline... if it get's off the ground will serve traditional CR food... it can't be worse than thier rivals...

7. Anne Patton A 3rd trial over the same allegation: she is the one featured in a documentary aired on TV recently. This will be here third trial on the same charge... an example of how things are never resolved in CR..

8. Arts Festival: just to follow through on this sad story of mismanagement and incompetence

9. Roche... expands company operations...

1. Government seeks $1.5 billion with new tax package

By the A.M. Costa Rica staffA tax package that the central government says it will send to the legislature this week disproportionally affects expats.

The measure would double the tax on transferring real estate, create a 15 percent capital gains tax and levy a 15 percent tax on money entering the country from elsewhere.

Real estate brokerage services and private medical care would be taxed as would hair care, accountancy work and, presumably, repairs by vehicle mechanics and nearly all other services.

The text of the bills still are not available. But the Ministerio de Hacienda released fact sheets. Many lawmakers are skeptical of the proposal for a value-added tax, and bills that get final approval may not resemble the original measure.

The proposal also would tax monthly rentals over 403,400 colons, some $764. The broad value-added tax would increase to 14 percent the tax on services and short-term rentals. The rate would be 15 percent in the second year. Tourism services by firms registered with the Instituto Costarricense de Turismo would be taxed at rates increasing more slowly.

The government proposes value-added tax rebates via a complex electronic system for 40 percent of the population it considers poor. Hardly any expats would be eligible for this.

Fact sheets on the proposals say that 97 percent of the workforce will not be affected by the income tax changes.

A.M. Costa Rica estimated, based on government figures, that the proposals would raise $1.5 billion in new taxes each year.

The government summaries on which this article is based did not clarify the way taxes would be assessed on money entering the country. Many expats receive bank transfers for pensions or they take funds from automatic tellers. These situations are not addressed in the summaries.

There also is the open question of money being transferred into the country for a real estate transaction or other investment.

Although the proposals say that taxes would not be assessed on payments to entities outside the country, there does not seem to be any provision to collect taxes on individuals who live here but are paid through foreign bank accounts. For example, some sportsbooks here pay their employees, particularly illegal ones, through accounts in Belize or Panamá.

The government has never addressed this form of evasion, perhaps for fear of creating unemployment.

The proposed value-added tax would generate $944 million at the end of three years, according to the Ministerio de Hacienda. The ministry said that it estimates that the new tax would generate 1.33 percent of the country's gross domestic product. That amount, the total of all goods and services, is estimated at about $71 billion.

The ministry also said that the income tax would generate 0.57 percent of gross domestic product in additional yearly taxes at the end of two years. A.M. Costa Rica estimated that to be $404.5 million.

The doubling of taxes on property transfers and vehicle transfers is estimated to bring in $135 million more each year.

In all, the new taxes would generate about 2.1 percent of gross domestic product each year, according to ministry figures.

That is about $1.48 billion.

The ministry accompanied the fact sheets with a press release outlining the ways the central government had reduced expenses since the beginning of the Luis Guillermo Solís administration. But as A.M. Costa Rica pointed out Monday, the cuts amount to about 2 percent of the annual budget.

2. Here are the details on the proposed tax package

By the A.M. Costa Rica staffHere are some of the aspects of the government's tax package.

Income tax

• Individual monthly salaries more than 793,000 colons up to 2.1 million colons would be taxed at from 10 to 15 percent, the same amount under the current law. Monthly incomes of 2.1 million to 3.2 million colons would pay 20 percent in income taxes. Those with higher income would remit 25 percent.

• Deductions would be allowed for payments to the Caja Costarricense de Seguro Social.

• Corporate taxes would remain at 30 percent. Lesser rates would be available for small and medium enterprises.

• A new capital gains tax would be instituted that would be 15 percent on any profit in the sale of real estate except for the primary residence.

• Deductions for interest and donations would be limited.

• Public agencies, such as the Refinadora Costarricense de Petróleo S.A. and utilities, would pay income taxes. Of course, these would be passed on to the consumer.

• Sports clubs would pay taxes.

• Taxpayers would be able to carry forward losses from previous years.

• Persons who receive payoffs when leaving a job would pay taxes of 15 percent on amounts of more than eight years salary.

Value-added tax

• The rate would be 14 percent the first year and increasing to 15 percent in subsequent years

• Tax covers all sales of goods and services

• Tax applies to rentals more than 403,400 colons a month, electricity over 50,000 colons a month and water above 30 cubic meters a month.

• The government would refund electronically beginning at a maximum of two years the estimated amount paid by those who are registered as poor with the Instituto Mixto de Ayuda Social. That's estimated to be 40 percent of the households in the country.

• Private medical care will be covered, but taxes for these services, except hospitalization and surgeries, will be refunded if paid by credit or debit card but not cash.

• Some basic food items, such as olive oil and tortillas as well as agricultural products such as rice and beans, would be exempt from the tax.

• Agricultural and commercial fishing supplies would be exempt.

• Private educational services would be exempt, as would the sale of wheelchairs and other aids for the disabled. However, educational entities would pay income tax.

Other taxes

• The cost of transferring real estate would go from 1.5 to 3 percent.

• The cost of transferring vehicles would go from 2.5 percent to 5 percent.

• Plastic bottles would be taxed at the point of sale at 10 colons per 250 milliliters up to 40 colons for a full liter bottle.

• Money coming into the country would be taxed 15 percent.

• The tax year would run from Jan. 1 to Dec. 31 instead of the period that ends now on Sept. 30.

No taxes

• Inheritances, company dividends and a limited amount of interest on bank deposits would continue to be tax-free.

• No changes are proposed for the free trade zones.

3. Finance Ministry submits tax reform bills to Legislative Assembly

The Costa Rican government moved this week to reform the country’s tax laws in an effort to attack the growing fiscal deficit, which has begun to raise alarm both here and abroad.

On Wednesday Costa Rica’s Vice President and Finance Minister Helio Fallas submitted to the Legislative Assembly two draft bills to amend the country’s sales tax and income tax laws.

Those bills look to increase revenue by $1.1 billion — representing just over 2 percent of the country’s gross domestic product — and to reduce the government’s fiscal deficit, which is estimated to reach 6 percent of national production, according to ministry figures.

“Both plans, as well as others currently under discussion at the Legislative Assembly, aim for more efficient public spending, better use of public resources and improved controls over tax evasion,” Fallas said.

The Solís administration’s proposal was first unveiled in March. The Finance Ministry collected public comments and suggestions on the proposals before submitting the reform bills this week.

Value added tax

The first proposal seeks to swap the current sales tax for a value added tax, meaning most products and services would be taxed. However, under the proposal, funds collected from the VAT on certain basic services and goods, like food, would be returned to lower-income taxpayers using an electronic system.

These taxpayers would also get a refund for taxes paid on monthly rent that’s lower than ¢403,400 ($747), private education and health services, as long as they are paid using credit or debit cards.

Fallas said some 40 percent of the population would receive a yearly tax refund under the proposal.

In addition, tax exemptions would apply to electricity bills for families whose consumption is lower than 250 kilowatts per month, and to water bills when monthly consumption is lower than 30 cubic meters.

Extending the number of taxed goods and services mostly aims at improving controls on tax dodgers, Fallas said.

The VAT tax would increase annually under the proposal, from 13 percent — the same as the current sales tax — to 15 percent in two years.

Income tax

Proposed changes to income taxes include two new salary brackets. Monthly income above ¢2,225,000 million ($4,120) and up to ¢4,450,000 ($8,240) would be taxed at 20 percent. All monthly income above ¢4,450,000 would be taxed at 25 percent.

The Finance Ministry estimates these new segments account for some 3 percent of the country’s workers.

Currently, monthly income above ¢793,000 ($1,469) and up to ¢1,190,000 ($2,200) is taxed at 10 percent, while all income above ¢1,190,000 is taxed at 15 percent. Monthly income under ¢793,000 ($1,469) would remain tax-exempt.

New taxes, old promises

The proposal also intends to tax at 15 percent all remittances sent abroad as well as profits derived from selling properties, as well as used vehicles, boats and planes.

Corporations owning sports teams that generate profits — currently exempt — also would be taxed as well as large cooperatives Both would be taxed at 8 percent.

The draft bill also introduces control measures aimed at reducing evasion, avoidance and loopholes according to standards developed by the Organization for Economic Cooperation and Development (OECD).

The fiscal period under the new proposed plan would run exactly as a natural year (Jan. 1-Dec. 31), replacing the current period which runs from Oct. 1-Sept. 30. Tax returns and payments should be made by mid-March and partial payments can be made in June, September and December.

President Luis Guillermo Solís stressed during his campaign the need for a fiscal reform. But he said he was against new taxes, instead favoring improved collection of existing taxes.

Still, new taxes are definitely part of the government’s current proposal.

A new “green” or environmental tax would be added to non-returnable plastic bottles — ¢10 per every 250 milliliter or its equivalent. That means a one-liter bottle would carry a ¢40 tax.

Solís said at a public event Wednesday that he’s aware that the reforms would affect mostly middle- and upper-class taxpayers, but he said the effects would be minimal.

Reactions

Finance Minister Fallas said the tax reform is necessary to lessen the fiscal deficit that is threatening the country’s historic social achievements. He also said Costa Rica was “the only country in the region that has not done any tax reform in the last five years.”

Entrepreneurs reacted negatively to the government’s proposal.

“This is not a good time to talk about taxes,” José Manuel Hernando, president of the Costa Rican Food Industry Chamber (CACIA), said.

He mostly noted that taxing goods and services that currently are exempt would be a blow to consumers.

“The government’s proposal really alarms and concerns our sector, which was been severely affected by the country’s economic situation, a total stagnation that has lasted for several months,” he said. Business leaders also fear the proposed reform would have a negative effect on job creation.

Rather than raise taxes, Hernando said business leaders are asking the government to reform its spending.

Ronald Jiménez, president of the Costa Rican Union of Private-Sector Chambers and Associations (UCCAEP), said there’s confusion about fiscal issues among the country’s leaders. He said government officials talk about taxes as the only way to fix the country’s fiscal problems.

“The fiscal reform discussion should be comprehensive and it must incorporate talks about cutting public spending,” he said Monday.

Hurdles to the government’s plan also could come from the Legislative Assembly as opposition parties have already started to show their rejection of the proposed bills.

Juan Jiménez Succar, leader of the National Liberation Party, said the party would not approve any new taxes as long as the government didn’t cut spending.

Libertarian Otto Guevara concurred, saying “it is necessary to first advance on proposals to curb the government’s current squandering.”

In order to enter into force, both bills must be discussed and approved by the full Legislative Assembly at two separate rounds of voting.

4. Putting Proposals into Perspective

The proposed plan does not have strong support in the legislature. Seven of the nine parties the Liberación Nacional (PLN), Unidad Social Cristiana (PUSC), Movimiento Libertario (ML), Renovación Costarricense, Restauración Nacional, Accesibilidad Sin Exclusión (PASE) and Alianza Democrática Cristiana parties, demand the government cut public spending before starting the debate on the tax reforms.

Only the ruling party, the Partido Acción Ciudadana (PAC) and the Frente Amplio (FA) support the changes. However, the FA is opposed to the VAT raised from 13% to 15%, accepted Gerardo Vargas, his chief of legislative block.

The government also lacks the support of the private sector, who want to see a more (4)efficient use of public resources and spending.

5. Costa Rica’s struggle with fiscal reform highlights its governance problems

The Costa Rican government’s struggle to launch fiscal reform to deal with its large and growing budget deficit brings into sharp focus the ongoing governance problems faced by President Luis Guillermo Solís and his administration.

With a Legislative Assembly in which Solís’ party lacks a majority, and faced with cutting deals to pass any fiscal reform legislation, Solís recently has been reaching out to opposition leaders in an effort to reach consensus on reducing the deficit, currently at more than 6.4 percent of gross domestic product.

Last week, President Solís, who served in the government of two-time President Óscar Arias, paid a visit to the Rohrmoser home of the Nobel laureate in an effort to get Arias to use his influence with the opposition National Liberation Party (PLN) on the reform issue.

Saying that Costa Rica could not afford to let Solís fail, Arias offered to “roll up my sleeves and go to work.” But he was skeptical that Solís could succeed where three former presidential administrations – including Arias’ own – had failed, beginning with Abel Pacheco of the Social Christian Unity Party (PUSC) from 2002-2006.

Political scientist Constantino Urcuyo said Solís’ visit with Arias could have political importance given that Arias has clout with a wing of the PLN that is in his camp, and Arias also could sway other factions of Costa Rica’s oldest party.

But that support will come at a price, Urcuyo argued, which possibly includes the institution of a value-added tax, the privatization of electricity generation or cuts in government spending – all measures Arias has supported in the past.

Calls for cuts in government spending as a condition for raising taxes have been repeated by many in Costa Rica, including leaders of the country’s powerful chambers of commerce and industry.

But Solís has been equally adamant that fiscal reform should not be accomplished on the backs of Costa Rica’s poor and working classes.

On Wednesday, Solís submitted a fiscal reform bill to the Legislative Assembly that would increase revenue by $1.2 billion, about 2 percent of GDP. Among other things, it would replace the 13 percent sales tax with a value-added tax of the same rate to increase to 15 percent within two years. Low-income Costa Ricans – about 40 percent of the population – would receive refunds using an electronic system.

Solís also paid a visit to former President Abel Pacheco earlier this week in a courtesy call that observers dismissed as of little political importance, given that the elderly Pacheco has alienated most of the leaders of the PUSC party. In any case, PUSC already has fallen into disrepute with scandals that saw two of its former presidents arrested.

‘Dysfunctional democracy’

After his meeting with Solís, Arias lamented that Costa Rica has become ungovernable because leaders, he argued, have a difficult time implementing their policies.

“In this dysfunctional democracy that we have, it is difficult to achieve what you propose,” Arias said.

He also lamented the recent legislative alliance between Solís’ Citizen Action Party and the leftist Broad Front Party.

Arias said the country needs the confidence of investors – both internal and from abroad – in order to grow and continue to develop.

“An alliance with a communist party does not generate that confidence,” he said.

Arias added that he was glad Solís disavowed his party’s alliance with one that many believe have aligned themselves with other leftist parties in Latin America and that find inspiration in the policies and philosophy of the late Venezuelan leader Hugo Chávez.

The Broad Front Party stunned Costa Rica’s political establishment by winning nine seats in the country’s Assembly in the 2014 elections, and some observers saw the PAC alliance with the leftist party as proof that the ruling party has a strong wing that harbors ideas in line with “chavismo.”

The 2014 elections also saw a party other than PLN or PUSC take power for the first time in recent history.

Though Solís and party founder Ottón Solís (no relation) were both formally members of the PLN, PAC came to power as an insurgent party made up of members from across the political spectrum, attracted by the party’s stand against the corruption that had created scandals for both major political parties in the recent past.

That anti-corruption stance aside, PAC has failed to become steady on its feet.

In an opinion piece in the daily La Nación, columnist and former Editor-in-Chief Eduardo Ulibarri said the administration is suffering from Solís’ inability to turn PAC into a true institutional party after he was elected president.

Ulbarri blamed in large part PAC founder Ottón Solís, who he said was intent on maintaining the party’s “ethical purity.”

“[Luis Guillermo Solís’ election] was the moment to make [PAC] into a modern political party with machinery, political philosophy, programmatic bases, stable leadership, opportunities for advancement and discipline. At the same time, it needed to develop its vocation for negotiation and governing,” Ulibarri wrote. “None of that happened, in large part because [Ottón] Solís presumed it would contradict the ethical purity to which he was obsessively tied.”

The result is a party that does not have the organization or coherence to govern as an established political party.

“Citizen Action, as a party, never came out of the closet,” Ulibarri continued. “Its internal weakness was a bill that came due when [Ottón] Solís was absent for 10 months, when a vacuum formed that made it possible for the party virtually to be taken over by one of its wings.”

As if the pressure from his own citizens is not enough, President Solís hosted a visit from Inter-American Development Bank President Luis Alberto Moreno on Tuesday, where Moreno told members of the press that the waiting for fiscal reform in the country ought to be over by now.

6. New Costa Rican airline plans to launch with flights to Central and South America, US

If all goes well with the permitting process, new Costa Rican carrier Air Costa Rica could be jetting people from San José to destinations in the U.S. and Central and South America before the end of the year.

Last week, Air Costa Rica had a public hearing before the Civil Aviation Authority (DGAC), concluding the certification process to become an air operator. The company submitted its application in May 2014.

Final evaluation and approval from the DGAC normally takes some 30 days. In the meantime, the carrier is launching negotiations with aviation authorities in countries to which it plans to fly, general manager Carlos Víquez Jara said Monday.

Air Costa Rica has already filed authorization requests with authorities in Panama, Nicaragua, Guatemala and Colombia. Víquez said daily direct routes from San José to those countries could start as soon as December.

The carrier is also preparing authorization requests for opening routes to Quito, Ecuador and Lima, Peru, but those negotiations could take up to six months, Víquez said. And Air Costa Rica is working to submit authorization requests to U.S. authorities to launch a nonstop flight to Miami next year. It also hopes to open routes to New York and Los Angeles.

The carrier’s marketing strategy will be based on quality service over discount service, Víquez said.

“We are not aiming for the low-cost niche but our rates will be cheaper than those from most current carriers,” he said. “We will be an ‘intermediate-cost’ carrier.”

The carrier plans to flaunt its Tico identity: Planes will be painted with the colors of the Costa Rican flag and will sport decorations evoking the country’s natural beauties.

“And they will display a big Pura Vida! sign,” Víquez said.

In addition, all flight crew members will be Costa Rican and they’ll wear uniforms with the flag colors.

On flights lasting more than 90 minutes, passengers will get traditional Tico meals, he said.

“The route to Miami, for example, is anticipated to have a 9 a.m. departure, meaning the menu will include a Tico breakfast with Gallo Pinto, tortillas, eggs, sour cream and coffee. For other schedules we will offer casados — Costa Rica’s signature dish — as we want our Tico passengers to feel at home inside our planes,” Víquez said.

The company’s staff currently consists of some 30 employees at its offices in San José, but plans are to expand the staff to some 100 employees by year’s end.

7. US expat Ann Patton faces third murder trial in Costa Rica

Ann Patton was back in a Pérez Zeledón court Monday for her third trial in five years for the 2010 death of her husband, the wealthy U.S. financier John Felix Bender.

Patton, a 44-year-old U.S. woman, moved with Bender to Costa Rica in 2000 with the aim of building an animal refuge on a sprawling estate in Florida de Barú, a remote community in southern Costa Rica.

After 10 years in the remote jungle, the couple’s opulent lifestyle fell apart when Bender died from a gunshot to the neck. Patton claimed it was a suicide. She said Bender had been depressed and that she tried to pull the gun away from him before he fired.

Prosecutors alleged that Patton killed her husband, who was 43 at the time.

Three trials later, Patton has never wavered in proclaiming her innocence. This latest trial, she said hopefully on Monday, would finally be the one to absolve her of any wrongdoing.

“I did not kill my husband,” Patton told The Tico Times.

Triple jeopardy

In her first trial in 2013 Patton was acquitted, but an appellate court ordered a retrial that was held in May 2014. The 2014 trial found Patton guilty and she was sentenced to 22 years in prison. Patton served nine months in El Buen Pastor prison in Desamparados, south of San José, before an appellate court in Cartago threw out the guilty verdict in February and ordered the retrial that started Monday. There is no prohibition against double jeopardy in Costa Rican law.

Fabio Oconitrillo, Patton’s lawyer, previously told The Tico Times that his legal team could prove that investigators manipulated evidence to implicate Patton as the shooter instead of her husband. Oconitrillo and Patton both have accused Judicial Investigation Police of perjuring themselves during the second trial.

The Tico Times was not able to reach Oconitrillo for comment.

Patton has chronic Lyme disease, a condition that has left her frail and walking with a cane. She reportedly weighed just 70 pounds at the time of Bender’s death.

Besides Patton’s freedom, the custody of $7 million worth of jewels is also in question. Authorities seized the jewels, claiming that they were contraband and did not have tax records. The Florida de Barú estate is also under dispute. Patton has a lawsuit pending against her former lawyer for control of the 5,000-acre property.

Upon her release in February Patton was ordered to surrender her passport and not leave the country. She has been staying with family since then.

Prosecutor Edgar Ramírez told The Tico Times on Tuesday that regardless of how the trial ended he foresaw another appeal.

“Neither side is going to be satisfied with the result,” Ramírez said, reflecting on the two previous appeals and the right of both sides to continue to appeal the case under Costa Rican law. “There are several outcomes that would result in another appeal.”

Patton showed more sangfroid when asked how the trial would end.

“I have faith that finally justice will be served,” she said.

8. Arts festival figures faced banning

By the A.M. Costa Rica staffA legislative committee wants to prohibit four persons involved in the last Festival Internacional de las Artes from government work for four years.

The Comisión Permanente Especial de Control del Ingreso y Gasto Público named Elizabeth Fonseca, who was minister of Cultura y Juventud at the time. Also named were two vice ministers, José Alfredo Chavarría Fennell and Luis Carlos Amador Brenes, as well as Inti Picado Ovares, who directed the festival.

The committee will present such a suggestion to the full legislature. If approved, the suggestion will go to the Fiscalía General de la Republica to be included with any legal action that might grow out of the festival. The festival is widely seen as badly managed.

Only a judge can order individuals to be excluded from public service. What happened with the festival does not seem to rise to the level of a crime, so there may not be any legal proceedings. The principal allegation is lack of coordination.

9. Roche expands Costa Rica operation with new service center

Swiss pharmaceutical company Roche opened a new service and distribution center in Heredia province on Wednesday, representing a $5.5 million investment.

The company expects the expansion will allow it to increase exports by 50 percent over the next five years.

Roche is also hiring 40 new employees for its administrative, commercial and health research departments. The new workers join 175 employees already working at the company’s local operation in the UltraPark free zone.

CEO of Roche Central America and the Caribbean Stephan Julsing said the investment decision came on the heels of considerable growth in the company’s regional operations in recent years. “We chose Costa Rica based on various factors, such as its political stability, the quality of the human talent and a strong legal system,” he said.

President Luis Guillermo Solís attended the inauguration and said Roche’s investment here represents a vote of confidence in the skills of local talent, which has allowed the company to grow continuously.

The new facilities also expand the company’s storage capacity and will help it implement technologies to meet the most recent environmental and energy saving standards, Julsing said at the ceremony.

Foreign Trade Minister Alexander Mora Delgado noted that Roche is one of 11 companies in Costa Rica’s service sector to expand local operations during the first eight months of this year.

The Basel-based company launched operations in Costa Rica in 1973. All of its production here is for export.

Brian, Lita, the Late Hugo IV, irreverent Vicka, the pigeon toed parrot, Chico II and Chica II

Previous reports

2024

2023

2022

2021

2020

2019

2018

2017

2016

2015

2014

2013

2012

2011

2010

2009

2008

2007