A Plan Falls Into Place Admist Various Pot Holes and Speed Bumps

ISSUE #985: June 2 - July 6, 2024

2024-07-09

Brian Timmons

Dear friends,

When I started Residencias Los Jardines, I started writing a weekly newsletter -determined to tell all the good, bad, and the ugly. I knew some readers would be interested in the construction process. I expected others might be interested in the lifestyle of two people who had decided to live outside the box. For others, the adventures of Lita, the parrot and the cat took on an entertainment saga all its own.

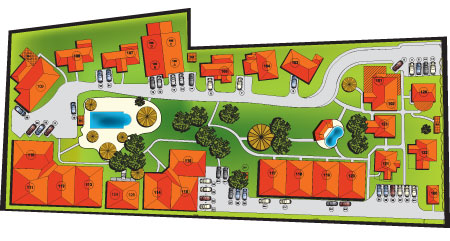

Residencias Los Jardines is finished. We periodically have re-sales and rental availability. Some readers may be interested in this information.

Brian Timmons

Developer / Property manager

Residencias Los Jardines

Web: https://residenciaslosjardines.com

Emails: info@residenciaslosjardines.com

ResidenciasPropertyManagement@gmail.com

sales & rentals

Sales: Los Jardines: Nothing available

Rentals:

Los Jardines: Nothing available

Paradisus: Nothing available

What Happened

Weather: We are now into the rainy season... regular rains... garden is happy.

Easy Stuff First

Los Jardines Status Report

1. Orchids: They are doing fine --growing, blooming, propagating and we have gotten the interest and personal dedication of one owner to really oversee this... The one surprise is that the "orchid tree" --large older tree to which we attached a number of orchids --creates too much shade for the orchids to bloom... they are very happy growning, propagating themselves... we are havesting the propogations, growing them to selfsustaining level and then will relocate them... This is a bit of a disappointment but it is also a opportunity since we would like to extend the plants around the property.

2. Various systems... Water, Internet, gates, electrical, pool heater and pumps... all are working as they should... and the preventive maintenance we did in areas during the dry season to make the transition to the rainy season, seem to have paid off...

3. Financial Status: With the 10% increase we think we have stabalized our negative cash flow... certainly we drew down some operating cash so we are tight but hopefully, we can manage until we can effect a change. The exchange rate has reversed its negative direction and has very moderately improved... from 490 / 500 to 520 / 534 --this is not enough to continue to live with without adjustments but for the time being we can adapt.

4. Tenants: They come, they go --it is amazing how tenuous some lives are and how easily it is for them to change what was expected to be a 1 yr committment becomes a 2 mo, 4 mo. etc. temporary layover... and we are left to clean up the results of their messy, tenuous lives. One tenant from Scotland signed a 1 year lease, two months later he leaves --famiy emergency. A Tica signes a 1 year lease... wants to move 4 mo. later... in the intermim, she has complained about high electricity... (you leave the lights on all the time), the refrigerator runs when I am not here... ( yes, duh --that is what it is supposed to do), my shower doesn't work --(ahhh see this knob here, it is the valve which turns your water on... oh wow!!!) some one entered my house and left the door open... (you didn't close it, you left it open), my door doen't lock (ah, see this knob here, turn it counter clockwise)... etc, etc, etc... she said she wanted to leave and wanted her deposit back... since I paid the realtor for a year's commission and only getting 4 mo. of value, I loose but to get her out the door, I agreed... this was 6 days ago... now she says she has no place to go, doesn't like what she finds, can't affort any place... I lost, told her to get her arss out the door... I was accused of being rud, nasty... etc... yep, hope you got the message... F...Off...

5. Traffic Chaos: While traffic is normally heavy and chaotic, the past several weeks and for the next few weeks it will be even worse... The state water company is putting a water pipe on three of the 4 streets we use for access to and from Los Jardines... dump trucks, backhoes, misc. equipment forcing a one way blockage... They seem to lay about 60 ft of pipe a day which is back filled, lightly compacted and the rest of the compaction will be done by traffic so the result is rough, potholed roads... at some time, the trenched area will be patched so that will --when being done-- create more chaos...

6. Government: The President seems popular with the people but not very popular with the Congress... they are at war... to the point that the President says the congress is dysfunctional and can't get anything substantive done so he wants to hold a public referendum on a number of substantive items... of course the congress hates this idea because it removes their meddling, their cuts, their influence and importance... we have our own mess but in a different way that N. Am.

7. Finanical Institutions: One of the smaller Cooperatives (Savings and Loans) failed. History shows that every two years there is a banking institutional failure. See articles below... the cause is usually the same... mismanagement at the director / senior management level, corruption, cover-ups, and lack of effective oversight... and as you will see in the articles... the system failures repeat them selves for the pat 20 years... nothing changes.

8. A Plan Comes Into Place: Now this brings me to my personal rant and experiences... while some of it has to do with CR, some of it is person / situation / age based while we are based in CR... so how does one (in this case, Lita and I --manage our transition to senior life and beyond? ...this is a work in progress. Three years ago (more or less) I started formulating the question of what do we do for this transition and how do we do it? Over the three years, I was able develop a master plan with some specifics... those specifics had to be operationalized and / or created --the results are now falling into place so I am in the process of implementing the plan... still a work in progress... While our plan is unique to our situation, we hope it covers off what we should do... plan for each others demise, live on one's own, asset allocations and separatons, taking care of each other, and family, etc... all those issues... a lot more needs to be done on some of these issues... virtually all issues are taking much longer than I expected --and I did not have high expectations but all are, I HOPE, nearing completion. Once the house was sold (parts of which continue with delays in finanlizing all issues and one major one is still outstanding but will be resolved), I had the key to put the pieces into the plan.

First was to take care of Lita... then, I would pick up / develop the specifics to my plan. We got Lita's plan in place and while not yet totally done, the plan is in place and we are comfortable with it. Now to deal with my situation... Over the past couple years, as I freed up mortgage loans through repossessions and cancellations, I ended up with disposable / investable cash... I looked for what to do with it knowing that I was going to have a master plan for this to work into --while it sat in the bank (which continued and continues to harrass --more on that later) getting 0.0025% interest... I did not want to do more loans nor did I want to buy more condos / properties to manage... both of these options had be ruled out of my plan. The reality is, CR offers nothing else except CDs... I invesigated ways to own stocks / bonds ...it doesn't really exist here... After a year of searching, I was able to find a "wealth manager" who takes his 1% and acts as an intermediary but no evidence of value added... and who knows if he will be there tomorrow and your money will be there???? I did not want to send it back to Canada --I have enough there and it is being managed and so is Lita's... so I wanted diversification and I did not want some bloody 30 yr old Compliance Officer telling me that this stock does not fit my profile so I cannot buy it... Screw that... In the mean time, BAC continues to harrass me asking for all types of financial documentation, CPA statements, notes, copies of ???? / Lawyer certifications... I am spending a fortune constantly feeding these bastards who give me $6 a day interest... I am spending $800 + my time and BS to feed them... And Scotiabank now wants to do the same thing with an account which has had no deposits for 8 years, has $2,800 in it, and has two automatic deductions from --Apple and Google, each month for a total of about $10... and then Scotiabanks's various charges... they want a CPA statement of source of income, justification / documentation of expenses... and with the Toronto house being sold, systems I put in to place for bill payment 25 years ago and which worked beautifully now can be undone --well, unwinding everything is not easy... Scotiabank CR, I have moved the auto deductions of one, and cannot find the account for the other but when they cannot get paid, they will contact me... So I will be closing that account Monday and having a nice drink afterwards... The larger issue is / was what to do with the investibale funds... the answer showed up in an email from a previous helpful banker... he worked at Scotiabank first, then moved to BAC, we followed him, he got reassigned so was only helpful for about a year, and then he disappeared... only to arise gain after 5 years or so... he had recently quite BAC and was now working for a International / European based stock / bonds / securities trading platform using European based banking acoounts... so I have spent 3 weeks setting up that system and on Thursday transferred initial funds to an account in Cyprus (we will see if it arrives by Thursday --hopefully it will). BAC didn't like to do this, but my guy was familiar with their system and rules so was instrumental in stick handling it all for me... Meanwile BAC asked for certain mortage papers all of whcih I had given them when I had made the loans and when the loans were canceled but they cannot find the information so I have to again supply it, it has to be certified, it has to be digitally signed, it has to be in 12 point font, black ink, white paper, with blue line on it... etc... one document was rejected because it did not have my address on it... wait a minute, I just updated my info that included that and it is the same info you have had for 8 years... the harrassment and stupidity never ends... so, now that I have an alternative... I will be moving funds off shore, out of the clutches of CR banking idiots... and my contact for all this, when asked, said I fit the profile of his client base... expats, with investment funds, no where to put them in CR, tired of the harrassment... With the exchange rate BS and the banking harrassment BS... my advice is do not bring more money into the country, than you need to live, do not do any business here, enjoy the weather, lifestyle, scenery, and private healthcare --medical and dental, etc.

Conclusion: Where there is a will, there is a way. I am not delusional, I still have a lot of issues, hurdles, roadblocks, and landmines yet to work my way through, but the plan (good or bad) is roliing out. Hopefully, by year end, I will be able to look back with relieve and some satisfaction and lower blood pressue.

9. Volvo: Is still a sick puppy... 2 1/2 mo. now. I could not find the key part I need on any of the internaional auto parts platforms... so reluctantly had to buy a new part... ouch!!!!! --I really had no choice... I am awaiting it's arrival... probably another 2-3 weeks before the car is operational again... I knew parts would be an issue, that is why I bought a back up car...it has become very useful and the decision to buy was obviously a good one.

Comments:

1/ 2/ 3. While banks at the branch level do their best to collect info --way beyond thier capability of understanding-- the oversight of financial institutions --banks / cooperatives (S&Ls) contiunes to be ineffetive within the regulatory bodies and between the regulators and the senior financial institutional management... and nothing changes...

1. Accumulation of embezzlements and frauds call into question Costa Rica’s banking controls

The Sugef and Conassif have the responsibility of controlling, supervising and preventing risks in investments made in the financial market; However, the case of Coopeservidores puts the focus on how efficient they are being, making the investment committees fall into error.

QCOSTARICA — The situation of the Cooperativa de Ahorro y Crédito de los Servidores Públicos, R.L. (Coopeservidores) – savings and loans – has put on the table a mirage that all people who invest see as a reality.

And, since there are regulatory and supervisory entities such as the Superintendencia de Entidades Financieras (Sugef) – Superintendence of Financial Entities (Sugef) or the Consejo Nacional de Supervisión del Sistema Financiero (Conassif) – National Council for Supervision of the Financial System, it is believed that there are sufficient precautions to avoid the risk of financial loss.

Nothing could be further from reality and, although the country has extensive regulations regarding regulation and control over the operation, accountability and functioning of financial entities, the supervisors are lax, slow and not very proactive in making appropriate decisions to safeguard the investments of Costa Ricans.

The regulatory scheme has not managed to prevent financial embezzlement, as in the case of Aldesa or, more recently, Coopeservidores, as well as many others that Costa Ricans remember, despite the fact that the supervisory entities have a very broad law that allows them to have access to privileged information about the behavior, almost in real time, of loans, investments and actions carried out by financial entities under supervision.

Regulatory and supervisory entities are tasked with overseeing and managing risks in financial market investments. However …

There are billions of colones that were never recovered of many individual and institutional investors, solidarity associations and even pension funds that invested and lost resources due to failed actions by financial entities.

Of course, there are always risks when investing, but it is evident that something is not working in the supervisory institutions and it is time to address it.

The university newspaper, SemanarioUniversidad.com consulted with several economists to analyze in depth the deficiencies that directly affect financial consumers.

According to economist and researcher, Leiner Vargas, the superintendencies have become accustomed to carrying out very bureaucratic management that is absolutely delayed in time, having the possibility, for example, of accessing audits, the minutes and documents of the cooperatives.

“It seems that they do not take the pertinent actions, almost irresponsibly,” said Vargas.

“The superintendencies, as an element of control or supervision, are lacking a modernization of their supervisory instruments; they have remained in the last century, in relation to warnings about the behavior of the supervised entities. Our regulation has not changed for many years, we are in a small, very oligopolistic market, dominated by a group of institutional actors and, therefore, we are creating a kind of self-confidence that generates greater risks for us,” Vargas questioned.

Prevent embezzlement: failed task

For economist and former Deputy Minister of Finance, Fernando Rodríguez, the supervisory entities have not managed to prevent financial embezzlements, and the situation of Coopeservidores is a reliable example, but not exclusive, since several similar cases have occurred in the past.

In his opinion, the cooperative should have transparently reported the problems it had with its loans and it is even questionable what happened with the external audits that financial entities are required to present, knowing who that external auditor was, the notes that were made, because if the problems had been identified in time, other solutions would have been possible. That was another weakness in this case.

“The issue is that the actions of the superintendencies did not allow us to foresee the chaos that was and we know, deep down, that this could happen again. Worse still, the financial system is based on trust and people leave their money in a certain entity with the purpose of investing it, but trusting that the resources will be paid eventually,” Rodríguez argued.

When people’s trust in financial institutions is broken, the system can falter and the possibility of investing savings with peace of mind is no longer the same, the great risk: that this distrust is spread to other entities, even affecting the entire cooperative (savings and loans) sector.

Obviously, Rodríguez added, the system is not infallible, but the stronger the regulation, the less likely it is that these embezzlements will occur. However, recent history shows a tendency in the world to make regulatory processes more flexible, each time generating more and more complex problems.

Insufficient controls require a replacement

“The work of inspection and control was owed, especially considering that we are a small, shallow market with information asymmetries, with participants who have market power, who continue to demonstrate collusive practices and with revolving doors that slap supervision in large-scale issues, which in the end are detrimental to the people who lost their money,” acknowledged economist Luis Carlos Olivares.

Because the controls and actions of the superintendencies and the Conassif have been lax and insufficient, the economist argues that it is time to think about a change, not only in the government of the supervisory entities, but to delve into the scaffolding and construction of the market, which has its flaws.

The country has a regulatory scheme that has had variations and that on paper complies with international regulations, such as the financial safety net, financial reporting and accounting standards for the public and private sector, investment committees and others, but it has not resulted in in timely detections, nor to mitigate risks.

It is urgent to close the gaps in terms of the revolving doors – the passage of some people through high positions in the public and private sectors at various times in their work career, generating conflicts of interest – because there are powerful participants in the market who, at the same time, have an impact on price formation schemes and regulatory policies.

“It is not possible that we see audited financial statements of a company, and that its members then appear in prudential supervision institutions and then as managing partners of supervised entities. This generates great opacities and does not promote effective competition, while there are no ex officio actions by the supervisory entities that, incidentally, when a situation like that of Coopeservidores occurs, restrict the use of information to the public,” said Olivares.

At the same time, the situation of Coopeservidores is a wake-up call to cooperatives, especially the largest ones, because they offer incentives that often create wrong conditions, and the effect of loss of trust could be transferred to others that offer financial services.

Domino effect for solidarity associations

According to figures provided by the Federación Costarricense de Asociaciones Solidaristas (Fecasppri) – Costa Rican Federation of Solidarity Associations, some 350 solidarity associations invested close to US$75 million in Coopeservidores, money that is definitely at risk of being lost.

They are organizations of solidarity workers who entrusted their savings to the cooperative, because it had a good reputation and an analysis of good financial health and, although they have investment committees, these are based on the qualifications previously made by the entities. supervisors.

Leiner Vargas indicated that it becomes a domino effect because institutional funds, such as those of workers’ associations, or even pension funds that have been lost in the past (although not in the case of Coopeservidores), can only invest in entities that are supervised, which supposedly assures them that there are lower risks.

“That is where the role of the superintendencies has been lax, they have lost quality because, time and again, goals are scored against them (referring to embezzlement), and, in many cases, there have been major capital flight where millions are at stake of dollars. But the institutional entities that invest also have to be reviewed, so that they diversify their investment risks and do not put so much money in a single entity,” said Vargas.

2. Costa Rica’s financial system registers 14 interventions in 3 decades: almost 1 every 2 years

QCOSTARICA -- Every two years, in Costa Rica, there is a financial shock: it is the average of interventions of supervised financial entities, which have ended in all cases with the closure of the entity whose economic health is under review.

Since the earthquake that the intervention of Banco Anglo represented for the banking system in 1994, reforms were promoted to the system that included the transformation of the Auditoría General de Entidades Financieras (AGEF) - General Audit of Financial Entities into the Superintendencia General de Entidades Financieras (Sugef) - General Superintendence of Financial Entities.

Despite this, in these 30 years, 14 interventions have been made on entities that were under supervision, with scenarios in which some of the problems are repeated, and questions about the delay with which the security guards act.

In the publication “Banking supervision in Costa Rica: a difficult path” (Supervisión bancaria en Costa Rica: un camino difícil”), published by the Academy of Central America in 2012, Oscar Rodríguez made an observation about five interventions carried out in the country between 1998 and 2004.

“In most of them, The loan portfolio with arrears of more than 90 days was corrected sharply upwards after the SUGEF inspections. In other words, bad loans were considered high quality as long as the SUGEF did not prove otherwise.”

This is a controversy that has not been diluted for more than a decade. In most interventions, there is criticism from those affected about supervision that seems to have problems learning lessons from the past.

Gonzalo Meza, legal advisor of the Federación Costarricense de Asociaciones Solidaristas del Sector Privado (Fecaspri) - Costa Rican Federation of Private Sector Solidarity Associations, representative of 350 solidarity associations that invested nearly US$75 million of their workers in Coopeservidores, commented that they are very critical regarding the supervision carried out in the country.

“One of the criticisms that we make and that we plan to take to the Courts of Justice is that this country does not learn from the mistakes of the past. The situation that we experienced at Coopeservidores happened at Coopemex 15 years ago, with falsified financial information, from a supervised entity, and in which there were signs,” he said.

Meza also assured that the Aldesa case showed similar problems, in this case, due to an inopportune action by the Superintendencia General de Valores (Sugeval) - General Superintendency of Securities.

“Supervision must vary, it is not possible that, in cases with months of alerts, it is said that they expect to reach grade 3 (insufficiency) to act. It is arriving when the patient is dead. There must be more timely actions, to safeguard the interests of investors when action can be taken in time,” he said.

All of this includes investors who, in the case of Coopeservidores alone, exceed 130,000 savers, to which organizations must be added, in this case, one in four of the solidarity associations, as well as a new link between the financial cooperative sector and a crisis.

And all this without adding the costs that banking entities such as the Banco Popular (BP), the Banco Nacional (BN), the Banco de Costa Rica (BCR) and even the Banco Nacional Hipotecario de la Vivienda (Banhvi) - National Housing Mortgage Bank, have had to absorb to avoid further contagion to the national financial system.

Financial interventions

In the last 30 years, there has been almost one financial intervention every 2 years. In most cases, it has been indicated that supervision reform was required to incorporate lessons learned.

Banco Anglo, 1994: Government questioned that since 1990 there had been administrative mismanagement, with excessive expenses, unsecured overdrafts and speculative businesses that produced losses of ¢16 billion colones. The intervention in June led to changes in financial supervision, and AGEF became Sugef in 1995.

Coopevan, 1997: Cooperativa de Ahorro y Crédito de Entidades Evangélicas R.L, intervened in January. In 1998, Sugef recommended that Infocoop evaluate its dissolution.

Banco Federado, 1998: This bank owned by 40 cooperatives was intervened in September due to liquidity problems, after a run on funds due to the crisis in Coovivienda. Its bankruptcy was filed in 1999.

Bancoop, 1998: Financial arm of the cooperative movement, it was affected by the Banco Federado crisis, and intervened in December due to the impossibility of reaching additional estimates for the loans granted. The National Bank assumed the assets, liabilities and equity of both Bancoop and the Federado.

Coovivienda, 1998: Intervened due to poor collection management, liquidity problems and unreliable information. It was proposed to give its assets to the Banhvi to compensate for the assistance it had received, but this process even deteriorated the Banhvi's assets; a negotiation with the Ministry of Finance was necessary for it to remit ¢14.8 billion colones as part of the state guarantee.

Viviendacoop, 1999: El Banco Hipotecario de la Vivienda (Banhvi) requested intervention in 1999 due to problems with the payment of its obligations and possible diversion of resources from housing bonds. The Banhvi granted him financial assistance of ¢20 billion colones.

Banco Solidario, 2000: Intervened in March due to a lack of capitalization and a dispute over its ownership, after Sugef concluded that the improvement of its portfolio did not correspond to reality. Their losses amounted to ¢48.8 billion colones.

Bantec, 2003: Intervened in August, as a result of poor management and risky businesses that caused debts of more than US$5 million. Its operations were acquired by Banco Improsa.

Banco Elca, 2004: Intervened after Sugef detected irregular management in the granting of loans that consumed the bank's capital. Declared bankrupt in March 2005, with a process that involved 800 creditors.

Coopemex, 2010: Intervened after the Sugef concluded that they hid information, no loans were reported to delinquent debtors and in two months sufficiency indicators fell 17%, the savings of 88,000 people were affected. Banco Popular acquired the loans portfolio.

Coopeaserrí, 2015: Intervened in February due to levels of equity sufficiency, reduction of assets and security risk and financial solvency, but associates complained that supervision could act sooner, because there were signs from the previous year. 100 families were reported affected.

Bancrédito, 2017: Its figures had weakened since 2016, it was intervened in 2017 after seven months in which it tried to separate itself from financial intermediation, affected by an increase in delinquencies and loss of businesses such as Development Banking.

Aldesa, 2021: Conassif ordered intervention in August, based on Sugeval's recommendation, after determining non-compliance with the investment policy in one of its four investment funds. In August 2022, its permit to operate was revoked, and the only surviving fund became managed by the BCR. It was declared bankrupt in July 2022. About 600 investors, owed US$171,582,116, were affected.

Coopeservidores, 2024: Conassif accepted Sugef's recommendation in May, in the sense that the information reported by the cooperative did not reflect the credit quality of its portfolio. On June 21, it was declared “unviable.” Some 130,000 people with deposits will now seek to recover funds. The share capital of the affiliates is approximately ¢46.9 billion colones.

3. Coopeservidores is officially declared “unviable”

QCOSTARICA -- Coopeservidores is officially bankrupt, but will avoid going through the formal bankruptcy process, announced on Friday, June 21, the Conassif appointed auditor.

"Because the results and findings of the audit confirm the non-viability of the entity. Specifically, it is confirmed, among other elements, that the entity does not have the capacity, neither currently nor in the near future, to comply with the requirements of solvency given the continuous deterioration in the credit portfolio.

"Additionally, there are no viable measures for the capital contribution necessary for the entity to operate regularly. These elements denote the characteristics of an unviable financial intermediary, according to the provisions of prudential regulations," said Marco Hernández, appointed by the Consejo Nacional de Supervisión del Sistema Financiero (Conassif) - National Council for Supervision of the Financial System.

On the other hand, the auditor presented a proposed resolution that would allow the rescue of a set of valuable and desirable assets, which would be excluded to a solvent financial entity.

“In exchange, this solvent entity must assume all deposits and guaranteed loans, which would serve to make payments to creditors, in a relatively short period, which is estimated not to exceed two months,” the statement indicated.

The president of Conassif, Laura Suárez, said that this path is the “most favorable option for all those affected, in order to recover the greatest amount of money from savers.”

Suárez and Hernández asserted that sending the Cooperative to a bankruptcy process would represent a greater social cost due to the time required for depositors and creditors to access the resources.

The proposed process would establish, they explained, two figures, a set of quality assets and liabilities of the Cooperative that would be transferred to a solvent financial entity and a second "bad bank", which would manage a trust with the primary objective of selling it completely in a maximum period of one year, while the recovery of said assets is managed.

Hernández explained a cut of around 20% would be applied to deposits of more than ¢6 million colones depending on what results from the resolution process.

The Conassif assured that these decisions "reiterate the commitment to finding the best possible solution for the protection of savers' resources, the financial stability of the country and the preservation of confidence in the financial system."

This process, according to the Conssif, “guarantees” that those who had savings of up to ¢6 million will recover all their money.

It is important to note that the Deputy Prosecutor's Office for Probity, Transparency and Anti-Corruption has a case open to investigate the actions of Conassif itself and the General Superintendence of Financial Entities (Sugef) in the case of Coopeservidores for alleged crime of breach of duties.

Last week, it was reported that an analysis carried out by Sugef revealed that it knew eight years before that the savings and loan's loan portfolio had been reduced by ¢14 billion colones between 2009 and 2016, with an especially serious reduction of close to ¢7 billion colones in 2014.

The report thus shows that the supervisory entities had known, for at least eight years, the financial situation of Coopeservidores, however, it was not until May of this year that their intervention was ordered.

The intervention of Coopervidoresbegan because the information requested from Coopeservidores on loan operations showed "serious deficiencies in its precision, consistency and integrity," which prevented it from truthfully reflecting the situation of the credit quality of the portfolio.

Exacerbating the situation, the cooperative had applied massive payment moratoriums, avoiding reclassifying loan operations into higher risk categories and without carrying out any collection management.

Previous reports

2024

2023

2022

2021

2020

2019

2018

2017

2016

2015

2014

2013

2012

2011

2010

2009

2008

2007